How will new European Sustainability Legislation Apply to Businesses?

The European Union has long been at the forefront of environmentally-focused legislation, having introduced the Waste Electronic and Electrical Equipment Directive (WEEE) in 2003, the Eco Design Directive in 2009 (it’s being updated now) and the Restriction of Hazardous Substance (ROHS) in 2003. And now, they have a suite of new laws under the European Green Deal that are designed to rapidly transform the economy to be circular and sustainable.

The European Green Deal is designed to transform the EU into a modern, resource-efficient and competitive economy by ensuring:

- no net emissions of greenhouse gases by 2050

- economic growth decoupled from resource use

- no person and no place left behind

Some of these laws will not only affect companies that are registered and publicly listed in the EU, but also those that have branches and sell products into the European Union. Take a look at the summary we have prepared below to see what they are and how these may affect your business. Beware, it’s a bit of an acronym soup and can be a bit confusing, but our guide is designed to help you navigate this with clarity.

Snapshot of New & Upcoming EU Sustainability Legislation

Summary of the New & Upcoming EU Sustainability Legislation, as of March 2023, covered in this article:

Non-Financial Reporting Directive (NFRD) will be superseded by the CSRD

Corporate Sustainability Reporting Directive (CSRD) Passed into law on Nov. 28, 2022

Corporate Sustainability Due Diligence Directive adopted a proposal for it on 23 February 2022

EU Taxonomy for Sustainable Activities, passed into law July 2020

Circular Economy Action Plan adopted the proposal in March 2020

Sustainable Finance Disclosure Regulation (SFDR): Level 2 has been in effect from 1 Jan 2023 but applies to June 30, 2021 filings (when Level 1 went into effect)

Sustainable Products Initiative (SPI), adopted a proposal in March 2022

Overarching Sustainability Reporting Requirements for Companies as part of the European Green Deal

Non-Financial Reporting Directive (NFRD)

The NFRD applies to public-interest entities with more than 500 employees and either a balance sheet total of more than EUR 20 million or a net turnover of more than EUR 40 million. They must include a non-financial statement in their annual report.

Non-financial statements have to include information on the company’s environmental and social activities, employees, human rights, anti-corruption and bribery matters (essentially what is covered by ESG, more on this in a moment). The report must include the business models, policies and due diligence process, policy outcomes, the main risks arising from the non-financial matters out of the entities’ operations and non-financial key performance indicators.

Corporate Sustainability Reporting Directive (CSRD)

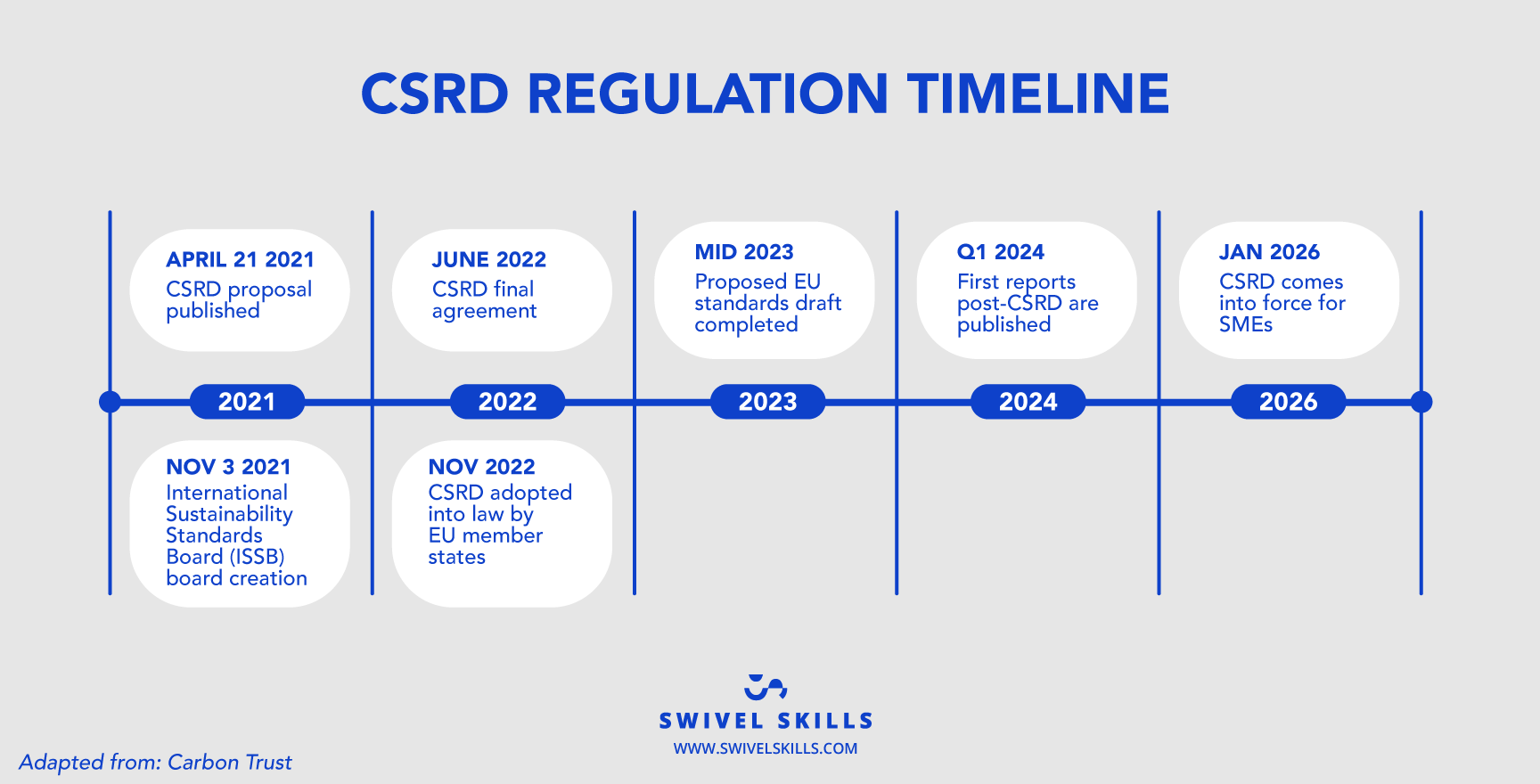

Passed into law on Nov. 28, 2022, by the European Union Council, the new EU Corporate Sustainability Reporting Directive (CSRD) mandates more detailed sustainability reporting in order to “increase a company’s accountability, prevent divergent sustainability standards, and ease the transition to a sustainable economy.”

The CSRD amends the 2014 NFRD and provides the regulatory framework for corporate sustainability reporting in the EU, as companies will need to account for how their business model impacts sustainability and in turn, how external sustainability factors impact their business.

A few key benefits to this is that stakeholders and investors will have better data to make more informed decisions and take action on sustainability matters. The general public will get access to transparent reports that must be made publicly available online, and there will be standards for reporting on environmental and social impacts caused by the company, but also the company must report on how social and environmental risks will impact on them (by conducting a double materiality assessment).

An estimated 50,000 businesses will be impacted by the CSRD, with all companies listed on regulated markets being included, as well as small to medium listed enterprises (SMEs) with specific characteristics, although there is an opt-out period for listed SMEs during the transitional period exempting them from reporting until 2028.

If you are a non-European company that has generated a net turnover of 150 million Euros within the EU and that has at least one subsidiary or branch in the EU then the CSRD will also apply to you.

In January 2023 the CSRD came into effect, and the EU Council has made a phased implementation approach with the required corporate sustainability reporting period beginning in 2025, based on the 2024 corporate fiscal year for large companies that are already subject to the NFRD; large companies that are not subject to this start reporting in 2026 for the 2025 year. Listed SMEs don’t have to start reporting until 2027 for the 2026 financial year, unless they use the opt-out, exempting them from reporting until 2028. For non-EU companies, they will start reporting in 2029 for the 2028 fiscal year.

Who will be setting the standards for the CSRD?

The organization that will set the standards for the CSRD is the European Financial Reporting Advisory Group or EFRAG, a private association encouraged by the European Commission to set up in 2001 to serve the public interest. In 2022 its mission was expanded to provide Technical Advice to the European Commission by creating a fully prepared draft EU Sustainability Reporting Standards. The proposed standards include what’s called a double materiality assessment, which is a way of engaging with stakeholders to define how the company creates impacts but also how they will be impacted by climate change.

The proposal also includes bringing in Scope 3 emissions under value chain sustainability reporting. This would require companies to report on indirect emissions that result from up and downstream activities, which are very difficult to measure but critical to getting a full-picture perspective on the impacts of an organization.

Even though the final standards are not released yet, companies should get started right away, as setting up data collection systems and ensuring everyone within the company knows how to measure and reduce their impacts will be critical to responding to the new legal reporting requirements. This is one of the reasons we created Swivel Skills — to help companies skill and equip teams with the right sustainability and climate literacy.

What Needs to be Covered per the CSRD?

The Carbon Trust provides a great overview of what will need to be covered under the CSRD:

“Companies must publish their information in a dedicated section of their company management reports, usually included in their annual report. Reports must cover:

Environmental matters — including science-based targets, EU Taxonomy and climate risk-related reporting

Social matters and treatment of employees

Respect for human rights

Anti-corruption and bribery

Diversity on company boards (in terms of age, gender, educational and professional background)

Companies will need to provide information that is:

Qualitative and quantitative

Forward-looking and retrospective

Based in the short, medium and long-term

The CSRD also features mandatory assurance for reporting by an independent assurance service provider against sustainability reporting standards. This is to make sure information is accurate and reliable.”

Corporate Sustainability Due Diligence Directive

The Corporate Sustainability Due Diligence Directive (CSDDD) hasn’t come into effect yet, but the European Commission adopted a proposal for it on 23 February 2022. The goal is to ensure that businesses inside and outside of Europe address adverse impacts associated with their actions and value chains by having to report on environmental considerations in a company’s operations and corporate governance.

In February 2023, EU lawmakers on the environment committee voted to increase the scope of the draft proposal, strengthening the requirements and falling into closer alignment with the CSRD.

Over the next few months, we will see how the proposal evolves and what the final requirements will be post-negotiations. My team will be keeping a close eye on this and will update as new information emerges. In the meantime, it’s good for everyone to start wrapping their minds around what due diligence changes across their organization and supply chains may entail.

Sustainable Finance

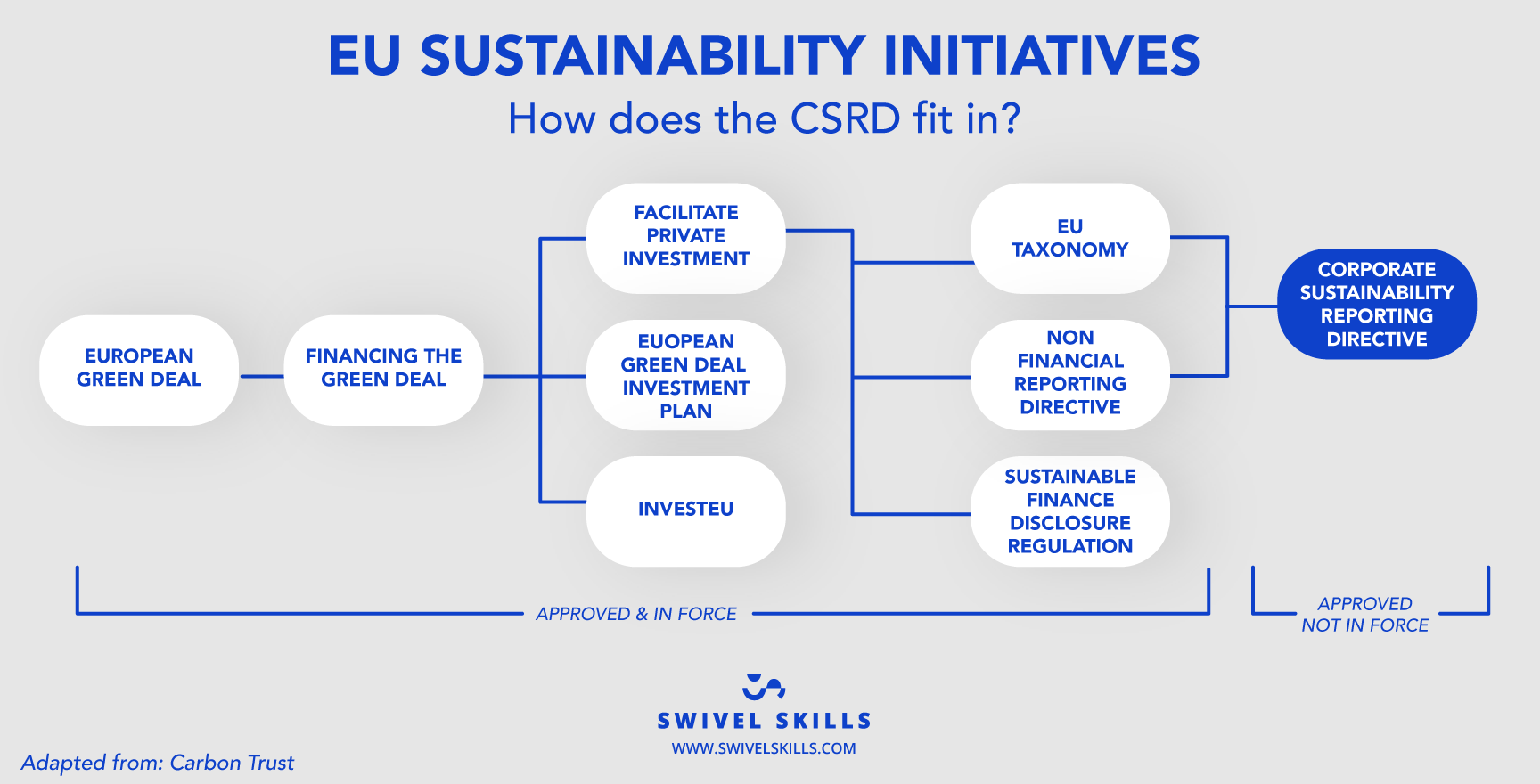

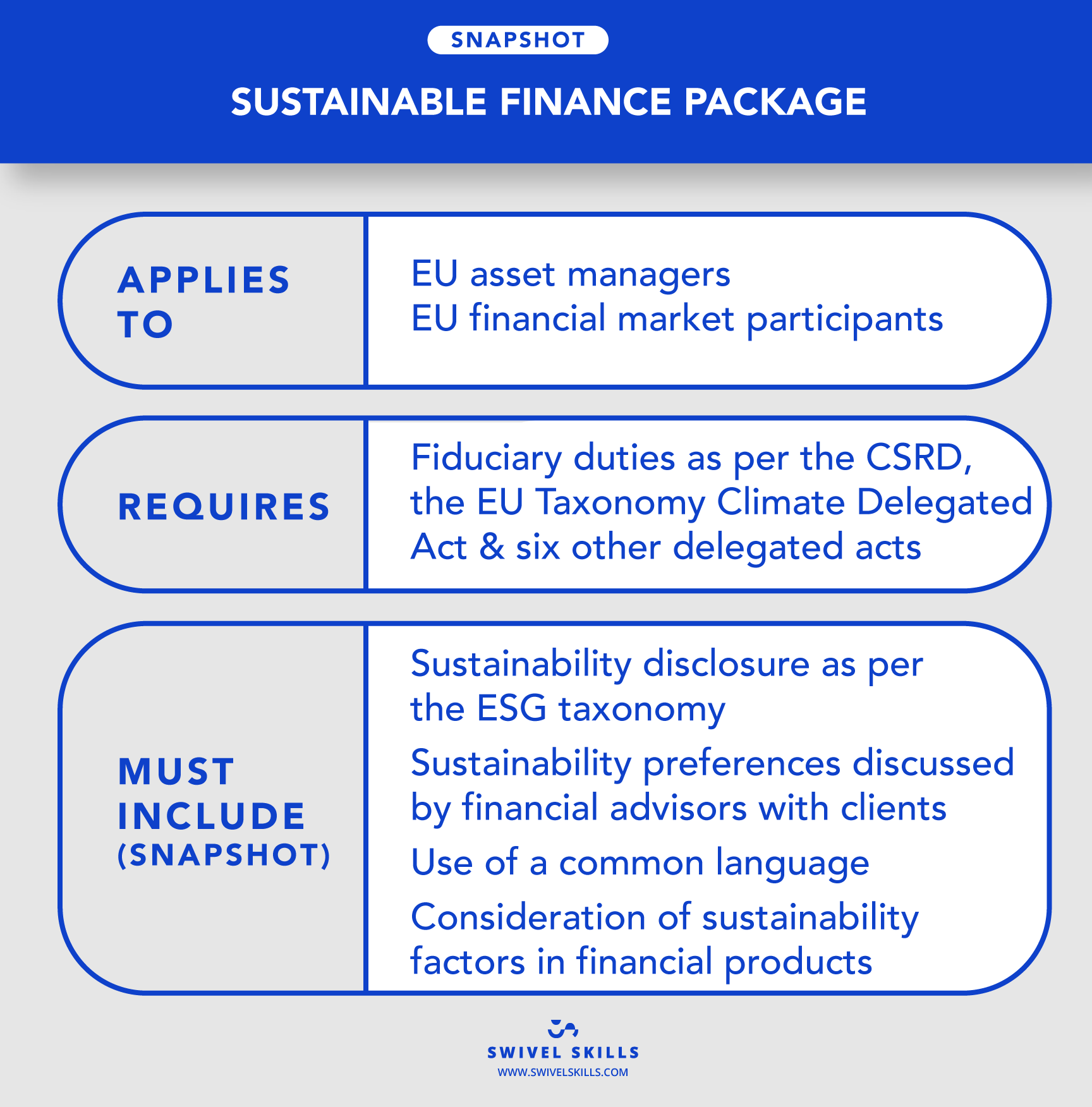

The Sustainable Finance Package is a set of laws that includes the EU Taxonomy Climate Delegated Act, the aforementioned Corporate Sustainability Reporting Directive, and six amending Delegated Acts on fiduciary duties.

The EU Taxonomy for Sustainable Activities is now in effect and provides a common classification system for sustainable economic activities, projects, and investments. The taxonomy is a classification system with a list of environmentally sustainable economic activities intended to help the EU scale up sustainable investment and implement the European Green Deal.

For asset managers and other financial market participants, the Sustainable Finance Disclosure Regulation (SFDR) applies to you. Level 2 has been in effect from 1 Jan 2023 but applies to June 30, 2021 filings (when Level 1 went into effect); it lays down sustainability disclosure obligations alongside the ESG taxonomy.

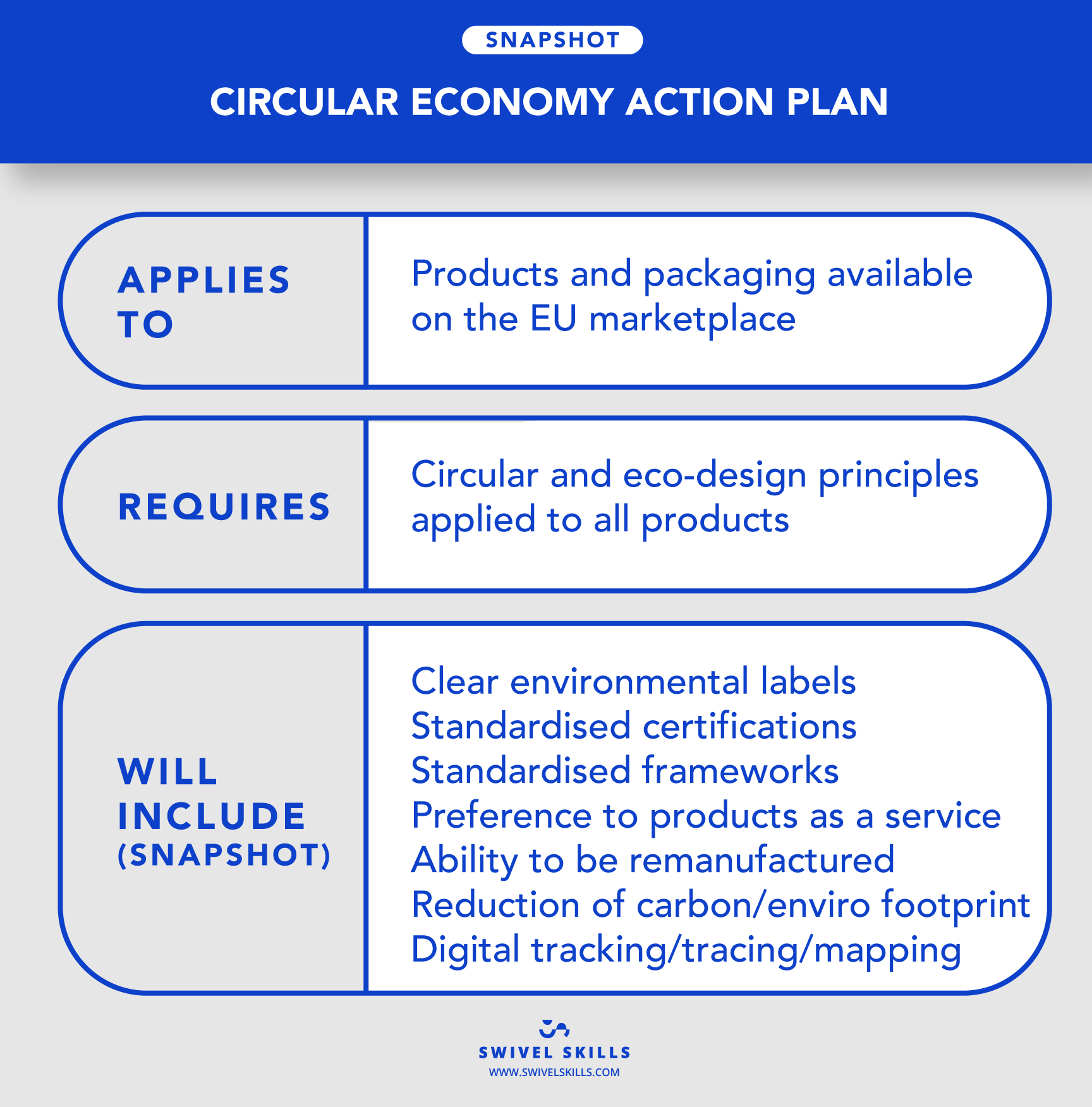

Circular Economy Action Plan

In March 2020, the European Commission adopted the new Circular Economy Action Plan (CEAP) as a core building block of the Green New Deal and a prerequisite of achieving the 2050 climate neutrality target. The PDF of the CEAP is available in full here; businesses have no obligations to take action just yet, but it’s good to prepare for future changes.

One of the main laws under this is the Substantiating Green Claims initiative, once in place, it will include a set of measures to clarify environmental labels on products and curb greenwashing. In 2022, the EU also revised the rules on Packaging and Packaging Waste proposal to ensure that “all packaging on the EU market is reusable or recyclable in an economically viable way by 2030” and builds on the 2018 Plastics Strategy that will ensure “by 2030 all plastics packaging placed on the market can be reused or recycled in a cost-effective manner.”

There is also an EU strategy for sustainable and circular textiles, a proposal for a revised Construction Products Regulation and a proposal for empowering consumers in the green transition.

Sustainable Products

To enact the circular economy and help achieve more sustainable production and construction, the EU adopted a proposal on 30 March 2022 called the Sustainable Products Initiative (SPI). It includes the new Eco Design Directive, which will enable the setting of performance and information requirements for almost all categories of physical goods placed on the EU market (with some notable exceptions, such as food and animal feed).

The SPI also includes a new “Digital Product Passport” (DPPs) whereby information about a product’s environmental sustainability will need to be provided and will set up frameworks for:

product durability, reusability, upgradability and reparability

presence of substances that inhibit circularity

energy and resource efficiency

recycled content

remanufacturing and recycling

carbon and environmental footprints

information requirements, including a Digital Product Passport

According to the European Policy Center, “DPPs can be valuable tools for enabling quick and convenient access to and sharing of product-related information. By scanning the tag (e.g. QR code), producers, consumers, waste operators and law enforcement agencies can easily access and possibly also upload relevant and targeted information for other stakeholders. This would come with multiple benefits. For example, easy access to information could empower consumers to purchase more circular products or inform repairers on how to fix used devices.”

DPPs are yet to be rolled out, as there has been a pilot on batteries over the last few years to see how viable this would be. The goal is to have the groundwork laid out for a gradual introduction of DPPs in at least three key markets by 2024. So watch this space!

Additional Sustainability-Related Laws

Sustainability is about social, environmental and economic considerations, and so the new EU Women on Boards Directive fits within the social space as it will require large listed EU companies to ensure by June 2026 at least 40% of their non-executive directors are women.

The EU regulation on deforestation-free products sets mandatory due diligence rules for companies that place specific commodities on the EU market that are associated with deforestation and forest degradation, including soy, beef, palm oil, wood, cocoa, coffee, and some derived products, like leather, chocolate, and furniture. Its purpose is to ensure that only deforestation-free and legal products (according to the laws of the country of origin) are allowed on the EU market.

Deciphering the Complexity

If you are feeling a bit confused and overwhelmed by this, then join the club! After 20 years of working in this space, I am grateful for this suite of new frameworks and standardized guidance, but also feel overwhelmed by the speed of these being rolled out and the confusion that is being experienced between say, how ESG is different to sustainability. Below I have addressed some common questions:

What’s the difference between sustainability and ESG?

Sustainability is an overarching framework for assessing and mitigating impacts, whereas ESG is a reporting tool that encourages more transparency in the financial markets. ESG does not usually require you to do a science-based impact assessment and then take steps to reduce these impacts (although that can be a part of your ESG policy), whereas sustainability is a set of technical tools for auditing, assessing and changing negative impacts, be it in products, operations or supply chains.

Are there board-level obligations?

More or less yes, boards are being required to take accountability; this is what ESG is about. The new laws are about good governance, due diligence and public accountability, all crucial aspects of a board’s responsibility.

Are these enough laws? Will there be more?

Despite all these actions, there is still some controversy over the strength and reliability of the standards. Claims that the ESG taxonomy has been influenced by lobbyists and allowed nuclear and gas to be included come along with criticism that the data points in the CSRD have been reduced substantially since the first draft.

Are there similar laws in other markets, such as the US?

At the federal level, there is the Inflation Reduction Act, signed into law in 2022 by President Biden. It invests more than $300 billion in climate initiatives an clean energy over the next 10 years. And then there are different laws at the state level, such as California’s AB 1201, which aims to prevent greenwashing by regulating product labels. Within Swivel Skills, we have a detailed database of all regulations based on country, state and city.

Where should you start?

Training and literacy is the first step, we have developed a learning platform called Swivel Skills for companies to rapidly upskill in sustainability, climate action and the circular economy. It is designed to fill the knowledge-action gaps and support organizations in responding to the changing landscape. We have dedicated action learning modules on regulations, along with practical advice on how to do environmental auditing, assessment and reporting.

— -

Join our sustainability in business activation masterclass in October 2023